Forex Trading

Forex Trading

Forex Trading

Any investment in foreign exchange should involve only risk capital and you should never trade with money that you cannot afford to lose. Forex trading, also known as foreign exchange or FX trading, is the conversion of one currency into another. It is one of the most actively traded markets in the world, with individuals, companies and banks contributing to a daily average trading volume of $5 trillion.

It is the term used to describe the initial deposit you put up to open and maintain a leveraged position. When you are trading forex with margin, remember that your margin requirement will change depending on your broker, and how large your trade size is. Leverage is the means of gaining exposure to large amounts of currency without having to pay the full value of your trade upfront. Instead, you put down a small deposit, known as margin.

72% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. To begin forex trading with City Index, simply follow our three-step guide to opening an account and you could be placing your first forex trade within minutes.

The modern foreign exchange market began forming during the 1970s. This followed three decades of government restrictions on foreign exchange transactions under the Bretton Woods system of monetary management, which set out the rules for commercial and financial relations among the world’s major industrial states after World War II. Countries gradually switched to floating exchange rates from the previous exchange rate regime, which remained fixed per the Bretton Woods system. Currencies are always quoted in pairs, such as GBP/USD or USD/JPY.

6. Closing your trade

Your losses aren’t limited to your deposit. A 2014 study of forex retail traders concluded that although 84 percent of Forex traders expect to make money in their accounts, only about 30 percent actually do. Most traders speculating on forex prices will not plan to take delivery of the currency itself; instead they make exchange rate predictions to take advantage of price movements in the market. A forward market is an over-the-counter marketplace that sets the price of a financial instrument or asset for future delivery.

4 ways to trade, plus MetaTrader 4

Try before you buy. Most credible brokers are willing to let you see their platforms risk free. Trading on a demo account or simulator is a great way to test strategy, https://forexhistory.info back test or learn a platforms nuances. Try as many as you need to before making a choice – and remember having multiple accounts is fine (even recommended).

The foreign exchange market is where currencies are traded. Currencies are important to most people around the world, whether they realize it or not, because currencies need to be exchanged in order to conduct foreign trade and business.

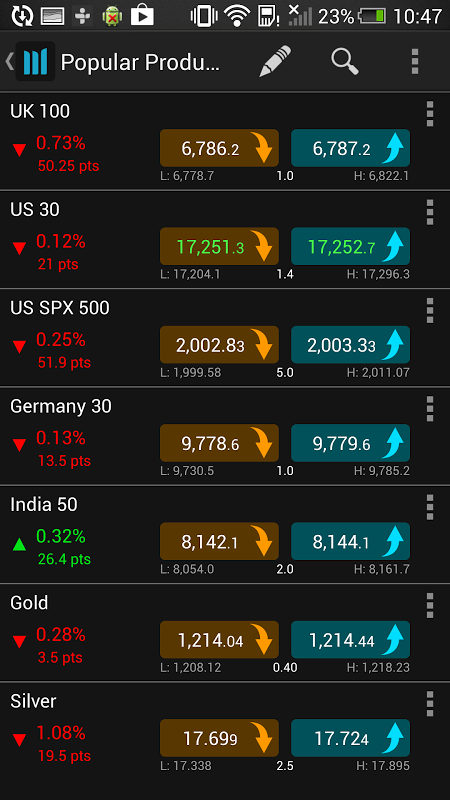

- Some commonly traded forex pairs (known as ‘major’ pairs) are EUR/USD, USD/JPY and EUR/GBP, but it is also possible to trade many minor currencies (also known as ‘exotics’) such as the Mexican peso (MXN), the Polish zloty (PLN) or the Norwegian krone (NOK).

- A minimum margin requirement of 8% is applicable (Professional clients only) along with a minimum trade size of USD 100,000 or equivalent.

- All trading involves risk.

- A pretty fundamental check, this one.

- They are commonly used by MNCs to hedge their currency positions.

IG provides execution only services and enters into principal to principal transactions with its clients on IG’s prices. Such trades are not on exchange. Whilst IG is a regulated FSP, CFDs issued by IG are not regulated by the FAIS Act as they are undertaken on a principal-to-principal basis.

Forex is also known as foreign exchange or FX trading and is one the world’s most widely traded markets, with $5 trillion traded every day. FX trading allows you to speculate on price movements in the global currency market. All forex trades involve two currencies because you’re betting on the value of a currency against another.

Automated Forex trades could enhance your returns if you have developed a consistently effective strategy. This is because instead of manually entering a trade, an algorithm or bot will automatically enter and exit positions once pre-determined criteria have been met. In addition, there is often no minimum account balance required to set up an automated system. If you download a pdf with forex trading strategies, this will probably be one of the first you see. Beginners can also benefit from this simple yet robust technique since it’s by no means an advanced trading strategy.

NDFs are tradable offline only through the Global Sales Trading desk. A minimum margin requirement of 8% is applicable (Professional clients only) along with a minimum trade size of USD 100,000 or equivalent. A higher margin requirement may apply depending on the level of exposure. Prior to trading this product an addendum to Saxo’s General Business Terms must be signed. At Saxo, we provide full electronic access to trade FX forward outrights in 100+ currency pairs with maturities from 1 day to 12 months.

Advantages of Forex Trading with XM

Trading in the Retail Off-Exchange Foreign Currency Market. Chicago, Illinois. Spot trading is one of the most common types of forex trading. Often, a forex broker will charge a small fee to the client to roll-over the expiring transaction into a new identical transaction for a continuation of the trade. This roll-over fee is known as the “swap” fee.

It is the world’s largest form of exchange, trading around $4 trillion every day, and it is open to major institutions and individual investors alike. Spread bets and CFDs are complex forex day trading strategies instruments and come with a high risk of losing money rapidly due to leverage. 75% of retail investor accounts lose money when trading spread bets and CFDs with this provider.

We offer a range of over 55 currency pairs and CFDs on precious metals, energies, equity indices and individual stocks with the most competitive spreads and with the no rejection of orders and no re-quotes execution of XM. Your Client Agreement with Easy Forex Trading Ltd (easyMarkets) has recently been updated. When you sell the currency, the opposite exists – you sell one of the base currency and buy the other. In USD/EUR at 0.84888 you sell 1 dollar and purchase 0.84888 euro. Unfortunately, there is no universal best strategy for trading forex.

Currency is traded in pairs, in both spot and futures markets. The value of a currency pair is driven by economic, political and environmental factors, such as wars, natural disasters, or national elections. Carefully look through the Forex trading examples here to ensure you understand how forex trading works. Once open, your trade’s profit and loss will now fluctuate with each move in the market price.

Comments are closed